Every day we make financial decisions, from day-to-day spending to choices that set us up for long-term financial wellbeing.

Yet, a new report reveals around 43% of adults in Ireland do not meet the minimum level of financial literacy – the essential knowledge and skills needed to manage money.

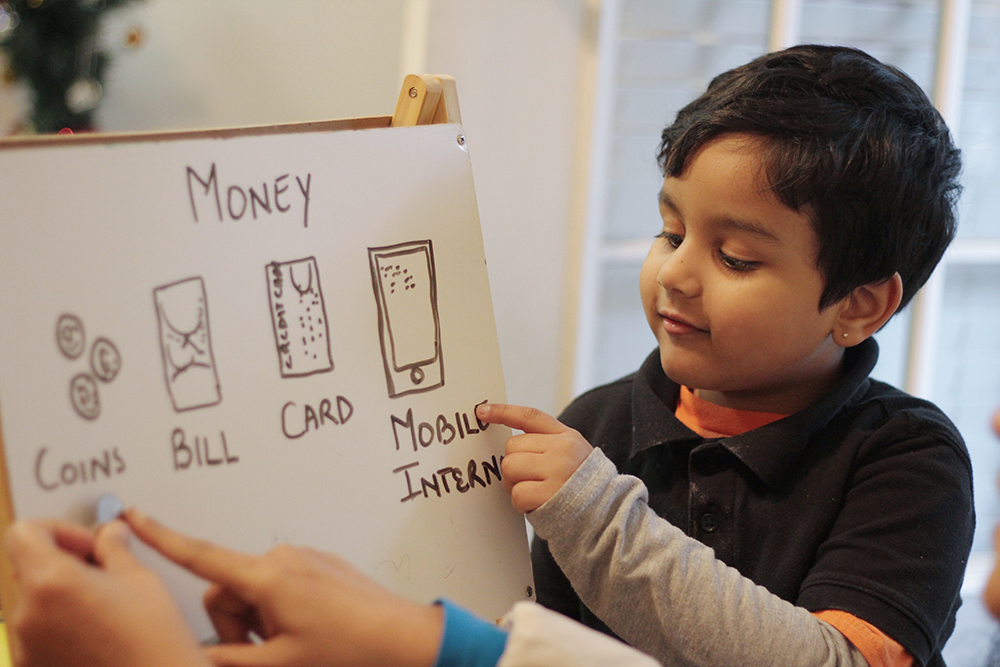

What’s more, the report by the Department of Finance recommends that education needs to begin earlier in childhood, preferably in pre-school, rather than the current norm of senior cycle in secondary school.

Nick Charalambous, financial advisor and Managing Director of Alpha Wealth clears the air on financial confusion.

“It’s never too late to start taking care of your financial wellbeing, but encouraging confidence and clarity around money at a young age, will lead to greater monetary stability, less stress, and a greater standard of living later in life.”

“There are things that every young person should be educated on and that I wish I had known,” he explained.

Nick has shared the five 5 financial lessons he wishes he could teach his younger self.

1. Discover the Magic of Compounding Early

The earlier you start saving, the better. Compounding interest is like a snowball—small at first but grows exponentially over time.

If someone offered you one million today or one cent doubled every day for 30 days, which would you choose?

For the record, by day 30, that cent would have grown to over €5 million, illustrating the incredible power of compounding.

2. Look Beyond Irish Banks for Saving

Traditional Irish banks aren’t the only options for saving your money.

Innovative banks like Revolut, based in Lithuania, and German financial institutions such as Trade Republic, Raisin & N26 offer competitive interest rates of up to 4%.

Diversifying where you save can lead to better returns and is an essential strategy for maximising your savings potential.

3. Handle Credit Like It’s Dynamite

Managing debt is crucial—always tackle high-interest loans first, beginning with the smallest balances.

This method of debt repayment can motivate you by quickly ticking off smaller debts, simplifying your financial obligations.

Think of your loan as a fantastic savings plan. The interest on your debts will always surpass any potential returns on investments once you allow for tax, fees, and risk.

4. Smart Tax Planning

Keep More of What You Earn: Taxes are the biggest expense you will face in your lifetime, so focusing on reducing Tax at every opportunity is vital to financial success.

Pension plans provide you with immediate tax relief and a great tool to use. Additionally, investing in initiatives like the Government Employment Investment Incentive Scheme, which offers 20%-50% tax relief, turns a portion of your tax expenses into profitable investments.

5. Protect Your Largest Asset

Your ability to earn an income is your greatest financial asset. Ensure you protect your income if your employer doesn’t cover it if you cannot work.

You can affect a protection plan and get tax relief on this to safeguard against unexpected illness or disability that could interrupt your earning potential.

Recognising and protecting this asset is key to long-term financial stability.